3 Ways to Reduce Stress With Video Games

August 10, 2021

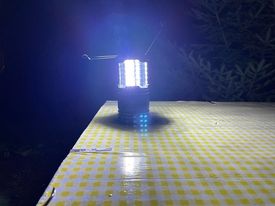

Vont LED Camping Lantern (Pack of 4) Review

November 19, 2021Long before entering the year 2021, homebuyer activity in America had slowed down due to pandemic fatigue. However, low inventory of homes on the market coupled with inflated buyer demand has created fierce competition in suburbs and medium-sized metropolitan areas like Jackson, Michigan.

Jackson County, Michigan is no different. Rents have risen, home prices have skyrocketed, and competition for properties is seemingly at an all-time high. These factors have combined to create a “sellers’ market”. A seller’s market exists when there are not enough homes available on the market to meet the demand for new buyers.

Low-interest rates, a high willingness to buy among existing homeowners, and continuing population growth across the US have all driven residential sales in 2020 and continue to do so in 2021.

Sellers have had the upper hand during this summer’s housing market in Jackson County, Michigan for existing homes, and it is reasonable to expect home prices to increase as a result – giving sellers more bargaining power. In February, the national median prices rose 15.8% from last year, according to the National Association of Realtors. Although this trend is expected to soften a little as builders have increased their number of permits for new construction. As more available properties enter the market, home prices will decline, but this will not be a quick process as homes take months to build.

Waiting for the pandemic to end, some housing market trends are expected to continue in Jackson County, Michigan such as interest rates will likely rise but stay relatively low and the number of homes on the market is expected to increase. This will make it harder for potential buyers. These trends are shaping the housing market this summer.

Nationally, in March, there were 52% fewer homes on the market compared to the previous year. This competition may drive up prices and increase the time it takes for a buyer’s offer to be accepted because they lose out to competing offers during their search. With remote work and virtual schooling becoming increasingly popular, many homeowners refused to relocate during the latter half of 2020 and this trend continues somewhat into the middle of 2021.

Fifty-four percent of the Michigan population receiving vaccinations, a better understanding of how coronavirus spreads, and declining unemployment numbers all make selling a home feel less risky in 2021. Inventory is expected to pick up this fall and hopefully, home prices will return to normal in Jackson County, Michigan.

Ratiu, president of Real Estate Investment Consultant for Market Trends Inc., says that while inventory will increase it won’t be at a fast pace because most house sellers don’t add to the inventory without also adding to demand. Most people who sell their home buy another one after they close on theirs.

The Coronavirus virus has also had a significant economic impact on the rental market in the United States, more than it has the homeowner property market. Renter households have been impacted significantly by store closings and other situations restricting their ability to get to work because they don’t meet essential needs for current jobs. In Jackson County, most renters are choosing to stay in their current homes instead of risking trying to find an available property in this overinflated rent market.

In response to the high demand, homebuilders have geared up for the production of new homes. Those aforementioned permits will turn into available homes, and some currently occupied properties will become available for rent or purchase. This will help to alleviate the shortage that has been seen in recent years due to a decrease in residential construction brought on the pandemic and its restrictions and will hopefully bring rent prices down along with home prices.

Renters and Homeowners looking for properties must be savvy and persistent to find the right deal at the right time. It can take many months to find a new place to live in the current housing and rental market.